Survey Says: Everyone's Craving New Culture Mozzarella

Wednesday, Jan 17, 2024

Download the full research report here: newculture.com/papers

News flash: pizza is a universally beloved food and a staple of the American diet (40% of Americans eat pizza at least weekly). With the rise in plant-based eating, almost one third of US pizzerias offer plant-based cheese because, yes, even people who avoid conventional mozzarella still love pizza. Yet we hear over and over again from pizzeria operators and eaters alike: existing vegan mozzarella falls well short of expectations. No melt, no stretch, sticky mouthfeel, no bouncy bite and a taste that’s just not quite right.

What if there was a cheese that not only appealed to those who prefer animal-free options but also to meat eaters – and even skeptics of vegan cheese? Luckily, here at New Culture, we’re hard at work.

To better understand the consumer appeal of our cheese, we conducted a comprehensive study in collaboration with leading custom market research firm AMC Global. We’re always eager to learn why people love cheese and pizza, and what motivates their purchase decisions. This research gave us a chance to better understand these important topics as we prepare for our product launch.

AMC’s findings uncovered broad appeal for New Culture cheese as well as its potential to reshape the culinary landscape. “Our market research suggests New Culture is well-positioned across a number of categories that are important to consumers, like sustainable production and taste,” said Shira Horn, Executive Vice President at AMC Global. “It’s been so rewarding to gather these deep consumer insights on a first-of-its-kind product like New Culture’s animal-free mozzarella.”

Here’s a summary of a few findings that stood out.

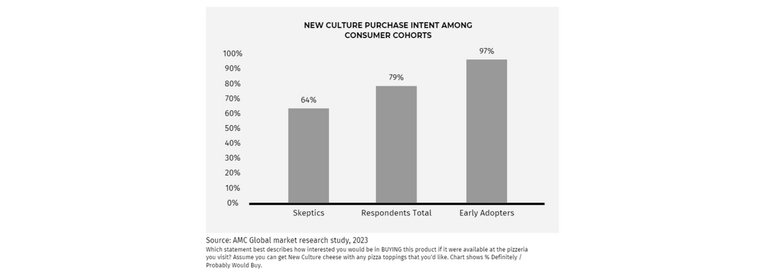

Pizzeria diners (including skeptics) are eager to buy New Culture cheese.

Four out of five of consumers would buy our animal-free, dairy cheese if it was available at the pizzeria they go to. For early adopters, that number shoots up to a whopping 97%. But it’s not only early adopters: 64% of skeptics want to buy New Culture cheese even though they aren’t generally interested in trying innovative food products.

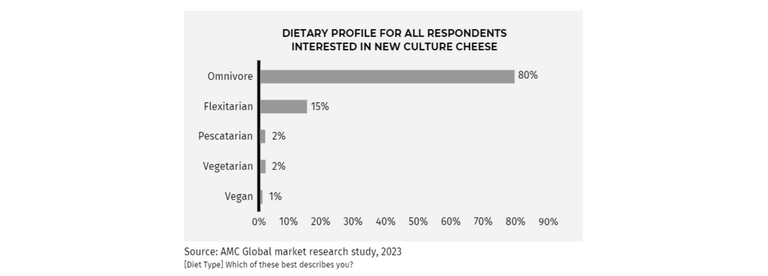

Meat eaters want New Culture cheese, too.

Of all consumers who expressed interest in New Culture cheese, 80% are omnivores and an additional 15% identified as flexitarians. In fact, when asked what toppings consumers would like to pair with New Culture cheese, pepperoni and sausage were both in the top six. The results strongly conclude that New Culture cheese isn’t a niche product. Our mozzarella appears to have mass market appeal, extending far beyond the narrower vegan segment.

Early adopters are willing to pay much more for New Culture cheese.

Perhaps a commentary on the quality of plant-based cheese, early adopters reported a willingness to pay up to $4 more per pizza with New Culture cheese vs. conventional dairy mozzarella. That’s double what consumers often pay for plant-based cheese. Such massive interest from these vocal, early consumers is critical for catalyzing word-of-mouth recommendations, which the overall respondent pool reported being the most common way they learn about alternative foods. Lower prices over time (thanks to reduced costs at larger manufacturing scales) will likely be a critical factor for adoption with more mainstream consumers.

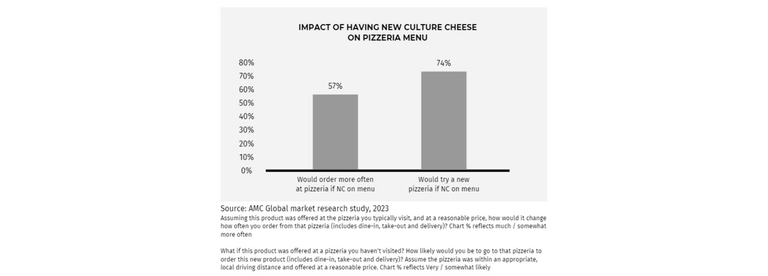

Consumers will travel for New Culture cheese.

In a surprising finding that bodes well for early adopter pizzerias, three out of four of consumers said they would seek out a pizzeria they’d never visited before just to try New Culture cheese. Furthermore, 57% of consumers reported they would order from a pizzeria more often just because New Culture cheese is simply on the menu. Taken together, the survey suggests eater excitement for New Culture has the potential to meaningfully transform purchasing behavior, including changing which restaurants consumers visit to buy pizza.

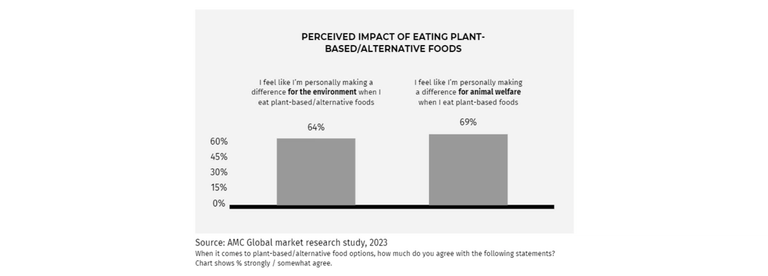

Animal welfare tops sustainability?

Sixty four percent of consumers feel like they’re making a difference for the environment when they eat plant-based/alternative foods. Unexpectedly, the results swell to 69% of consumers feeling like they make a difference for animal welfare when they eat plant-based/alternative foods. This surprising finding suggests there may be an opportunity to explore shifting perceptions of animal welfare on consumer behavior. The positioning of innovative foods is often focused on sustainability - AMC’s results highlight this focus may be overlooking another equally, if not more, important driver in animal welfare.

Overlap between plant-based consumers and interest in New Culture cheese

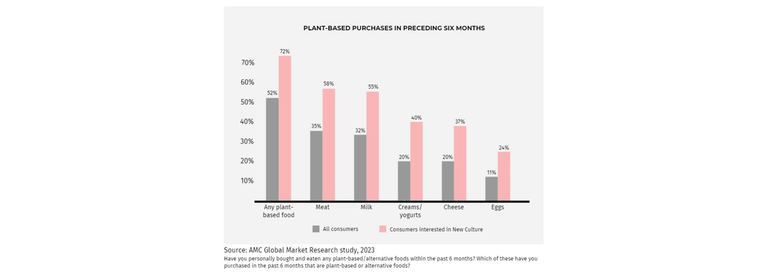

Interestingly, respondents showing an interest in New Culture cheese also demonstrated a higher commitment to plant-based food purchases overall. They were 1.4x more likely to have purchased plant-based in the last six months, with over half buying meat and milk categories. This suggests that plant-based purchasers are more likely to gravitate towards and try new animal-free foods - including New Culture - as they come on the market.

Taste (still) matters most.

Echoing findings from other studies, only 41% of consumers would eat an alternative food product if it didn’t taste as good as the conventional version. For New Culture cheese, consumers commented on the importance of trying the product first before reaching any conclusions. Capturing a common sentiment, one skeptic remarked “I like the idea that it melts and tastes like cow-dairy cheese,” followed by another that New Culture cheese “might not taste as good as it looks.” The proof will ultimately be on the pizza.

This study highlights the enormous potential of animal-free mozzarella produced using fermentation-made dairy protein. New Culture cheese offers an unparalleled solution to reshape the unsustainable cheese industry. So, whether you're a vegan, an omnivore, or anywhere in between, get ready for a melty, gooey, planet-friendly slice, courtesy of New Culture, coming to a pizza plate near you.